Material Management (Purchase Management) Purchasing is defined as the function of a business responsible for market exploration to procure goods and services of desired quality and quantity at the lowest price and at the desired time. It is a managerial activity.

Table of Contents

Objectives:

- To ensure that materials are supplied at the right time in a drug store.

- To avoid wastage and shortage and to maintain optimal stock.

- To achieve economy and efficiency in the activities of the firm.

- To reduce investments.

Mode Of Purchasing:

This is done by

- Inspection.

- By sample or pattern.

- By description or brand.

Methods Of Purchasing:

This mainly depends on a production system, the policy of the organization, and the behavior of the market. The different methods adopted are

- Purchase By Requirement: Here the purchasing is done as per the requirements of the goods and their sales.

- Scheduled Purchasing: This is the most scientific method of purchasing. Here proper balance is made between the amount procured and the amount required.

- Speculative Purchasing: Here purchasing is done as per the speculations present in the market or by the offers present on that particular product.

- Contract Purchasing: This is done as per the agreement with different suppliers for a period of time.

Staff Management

The different teams performing different duties in a community pharmacy are

- Purchase Team: Their main duty is to make sure that desired products are made available in the pharmacy and to see that the entire product sold is of high quality and prized seasonably.

- Dispensary Team: The dispensary team manages prescription medicines to be dispensed in the pharmacy. Their duty is to ensure patients and doctors that medications are safely and correctly supplied with appropriate patient counseling. They can also advise on a variety of healthcare issues.

- Business Team: The business team manages the record-keeping and financial status of the community pharmacy. They analyze the data of sales, and expenditure and develop budget strategies.

- Merchandising And Advertising Team: They look after pharmacies’ aesthetic and logistical integrity. They design and create displays, arrange products on shelves, and keep the store clean and comfortable. The advertising team creates promotion of the pharmacy through palm plates, ads on TV, radio, etc. They coordinate lectures workshops etc to increase the sales activity.

- HR (Human Resource) Team (Or) Personnel Team: They maintain a healthy work environment in the pharmacy. They hire and train new staff. They also encourage staff to get additional qualifications and specializations.

Display Management Or Merchandising

Merchandising is the scientific art of placing and positioning products on the shelves of pharmacies.

- Drugs should be stored in the pharmacy in such a way that pharmacists can supervise.

- All the stocks received should be physically checked and cross-verified with purchase orders.

- Scheduled drugs should be kept in a locked cabinet separated from other medications.

- The fast-moving products are kept handy near the counter and the bulk of drugs should be kept on bottom shelves.

- Train your staff in stock-keeping units. This will help for better inventory control.

- Create new shelf space for specialty products. Eg: Fiber foods, seasonal products, vitamins, etc.

- Storage should be done according to drugs and cosmetic rules – 1945 Eg: Store in a cold place i.e. between 20 degrees c to 30 degrees c. Store at refrigerated temp (2 degrees – 8 degrees c), etc. The arrangements can be made by following the methods

- According To the Manufacturer: The drugs are arranged in the drug store manufacturer-wise. Eg: Cadila Health Care, Piramal health care, etc.

- According To Pharmacological Action: Here drugs are arranged as per the pharmacological action. E.g.: All multivitamins in one rack.

- According To Alphabetical Order: Here drugs are arranged alphabetically. The drugs starting with the first letter “A” are placed in one row and the letter “B” is stored in the next row.

- As Per Oldstock And the Date Of Expiry: These are arranged as per the expiry. The older drugs are placed in the first row followed by the next. The drugs should be sold prior to the date of expiry.

- Numerical Method (Scientific Method): This codification is applied in or to companies that stock a large number of items. In this method, similar items are grouped together and each group is allotted a specific number. Eg: All anti-diabetic drugs are coded as 1. Glimpiride – 1.1, Metformin – 1.2 and Piaglutazone – 1.3 etc.

Books Of Original Entry:

The different records used are

- Legal records

- Patient records

- Financial records.

Financial Records

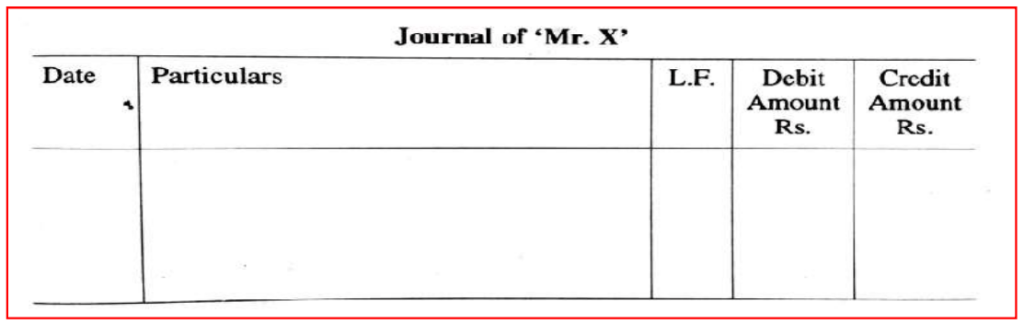

Journal:

The journal is the book of original entries. Here all the transactions are recorded when they are made. The process is called journaling. Here the accounts are not balanced. The transactions are initially recorded and then posted into the ledger.

Eg: Opening entries, closing entries, sales transactions, etc.

Column 1 – Date of Transaction entered.

Column 2 – It is the narration column.

Column 3 – It is used to record the page number of the ledger in which a particular amount is posted.

Column 4 – The amount to be debited to the account.

Column 5 – The amount to be credited to the account.

The total will be forwarded to the next page and so on up to the last page which gives the final total.

The different types of Journals are

- Purchase Journal.

- Sales Journal

- Purchase return journal.

- Sales return journal.

Cash Book:

- It records all the transactions related to cash. A Cash Book is also called a book of original entry since the transactions are recorded from source documents.

- The cash book acts as both a journal and a ledger. Here the receipts of cash are entered on the debit side and the payments of cash on the credit side.

- The word “TO” is written before the debit entries and “BY” is written before the credit entries.

- The recordings of transactions in a cash book take the shape of a ledger.

NOTE:

The recordings of the cashbook should always show a debit balance. (i.e. cash in hand).

- Single-column cash book: It contains only one column of amount. The cash account is divided into two sections. The debit entries are made on the left-hand side and credit entries are on the right-hand side.

- Double-column cash book: If a businessman allows a cash discount then a two-column cash book is needed to record it.

- Three-column cash book: It is the most popular. Here the first column is for discount. The second column is for cash and the third column is for bank.

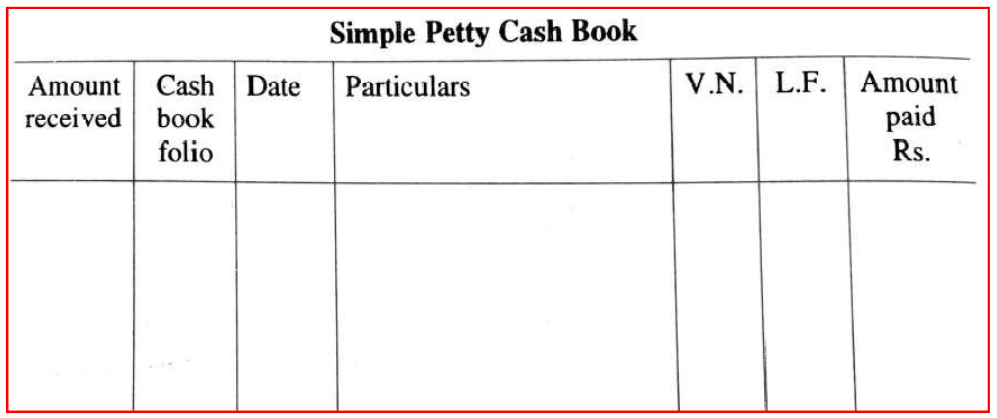

- Petty cash book: A large number of small payments such as stationary, postages, auto fares, etc are difficult to enter into the ledger. Hence petty cash book is maintained where a definite amount (interest money) is spent weekly and posted into the ledger.

Ledger:

- A ledger is a book of second entries that contains a permanent record of all business transactions.

- Here all the entries present in a journal or day book are transferred into a ledger and accounts are balanced.

- In the ledger every account will be allotted with one or more pages and pages of the ledger are called folios.

- All the accounts are identified in alphabetical order written on the front page of the ledger.

- Each page is divided into two sections by means of the central vertical line. Here all debit entries are made on the left-hand side and credit entries on the right-hand side.

- The process of recording entries in the ledger is called “Posting”.

- The different ledgers are

- Stores ledger.

- Job ledger.

- Stock ledger.

- Cost ledger

Trial Balance Sheet:

- It is not an account.

- It is defined as a statement of debit and credit totals or balances extracted from various accounts in a ledger to see, and check the arithmetic accuracy of books.

- Here the total of all debit balances must be equal to all credit balances if accounts in the ledger are accurate.

- It also helps in locating errors and preparation of final accounts.

- It helps in checking any items in the books of original entry that do not have a ledger folio.

- A trial balance can be prepared at any given point of time in business.

- Generally, the opening stock appears in the trial balance and not the closing stock.

- It can be prepared by

- Balance method.

- Total amount method.

Disadvantages:

- It is not recognized by the court.

- Not possible to have information about net profit or net loss.

Balance Sheet:

- The balance sheet is the statement of accounts prepared to find the exact financial position of the business on the last date of the financial year.

- It is a so-called balance sheet because it is prepared on a sheet of ledger folios.

- It is a statement of assets and liabilities. All the assets are entered on the right-hand side and liabilities on the left-hand side.

- In this personal accounts and real accounts are shown.

- It is prepared from the Trial balance sheet and the total on both columns should be the same.

- It is recognized by the court and it provides information about the stability of business i.e. trading firm solventing etc.

Profit And Loss Accounts:

- It provides information regarding net profit and net loss.

- They show results up to a fixed date.

- Here only nominal accounts are shown.

- If the total amount on the credit side is more than the debit side then it shows net profits.

- If the total on the debit side is more than the credit side then it shows a net loss.

- The net amount is deducted from the capital and entered in the credit side “BY NET LOSS”.

Legal Records:

The Pharmacist is responsible for maintaining up-to-date records of specific classes of drugs and poisons according to the Drugs and Cosmetic Act of 1940, and the Poison Act of 1919.

He is responsible for maintaining accurate records related to the acquisition and disposition of certain drugs that have the possibility of misuse or abuse.

Eg: Narcotic records etc.

Patient Records:

It mainly provides basic information about the kinds and amounts of drugs being taken by average patients who help in reducing the problems associated with drug interactions, economic purposes, past histories, information regarding insurance claims, etc.

Make sure you also check our other amazing Article on: Community Pharmacy Management